Free EMA Crossover with RSI Confirmation and ATR-Based Stops | Trend Following Strategy

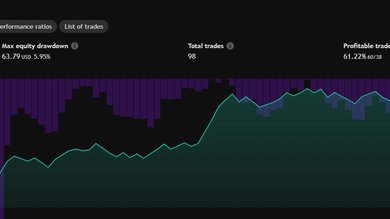

Performance Metrics (Author Provided)

- Win Rate: *

- 62.00%

- Profit Factor: *

- 1.58

- Max Drawdown: *

- 5.95%

- Sharpe Ratio:

- 1.20

- Sortino Ratio:

- 999.00

- Total Return:

- 13.00%

- # Trades:

- 98

Performance metrics are author-provided and not verified by StratiZone. Metrics marked with * are required submissions.

Description

Core Concept & Logic:

This strategy utilizes a powerful combination of Exponential Moving Average (EMA) crossovers and Relative Strength Index (RSI) filters for signal validation. It includes dynamic risk management by setting Take-Profit and Stop-Loss targets based on the Average True Range (ATR).

How It Works & Signal Interpretation:

EMA Crossovers: A bullish signal is generated when the faster EMA (20-period default) crosses above the slower EMA (50-period default), indicating upward momentum. A bearish signal occurs when the fast EMA crosses below the slow EMA.

RSI Filter: Ensures entries aren't made during extreme market conditions (avoids longs when RSI > 70, avoids shorts when RSI < 30).

ATR-Based Stops: Automatically calculates realistic Stop-Loss and Take-Profit targets, helping manage risk relative to recent volatility.

Key Input Parameters:

Fast EMA Length: Recommended between 10-30 (default 20).

Slow EMA Length: Recommended between 40-100 (default 50).

RSI Length: Typically 14 periods.

RSI Overbought Threshold: 70 (standard RSI practice).

RSI Oversold Threshold: 30 (standard RSI practice).

ATR Length: Typically 14 periods for standard volatility measure.

Stop-Loss Multiplier: Recommended range: 1.5-2.5 (default 1.5).

Take-Profit Multiplier: Recommended range: 2-4 (default 3).

Ideal Usage & Performance Scenarios:

Performs well in trending markets (stocks, crypto, forex).

Potentially weaker during choppy or sideways markets due to false EMA crossovers.

Ideal on timeframes like 1H, 4H, and 1D charts.

Known Limitations & Risks:

EMA strategies can produce false signals in ranging markets.

RSI filter may limit entries in persistently strong trending conditions.

ATR-based stops might not accommodate sudden volatility spikes.

Suitability & Keywords

Assets:

Timeframes:

General Tags:

Try Trading on TradingView

Build, back-test and trade this script on TradingView's world-class charts. Start free-upgrade only if you love it.

*Affiliate link—commission supports site; no extra cost to you.

StratiZone

StratiZone