Find Your Edge: The Ultimate Strategy Directory

Explore user-submitted indicators and strategies, or share your own masterpiece!

Register to Submit Yours!

Free EMA Crossover with RSI Confirmation and ATR-Based Stops | Trend Following Strategy

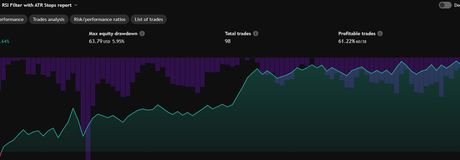

Core Concept & Logic: This strategy utilizes a powerful combination of Exponential Moving Average (EMA) crossovers and Relative Strength Index (RSI) filters for signal validation. It includes dynamic risk management by setting Take-Profit and Stop-Loss targets based on the Average True Range (ATR). How It Works & Signal Interpretation: EMA Crossovers: A bullish signal is generated when the faster EMA (20-period default) crosses above the slower EMA (50-period default), indicating upward momentum. A bearish signal occurs when the fast EMA crosses below the slow EMA. RSI Filter: Ensures entries aren't made during extreme market conditions (avoids longs when RSI > 70, avoids shorts when RSI < 30). ATR-Based Stops: Automatically calculates realistic Stop-Loss and Take-Profit targets, helping manage risk relative to recent volatility. Key Input Parameters: Fast EMA Length: Recommended between 10-30 (default 20). Slow EMA Length: Recommended between 40-100 (default 50). RSI Length: Typically 14 periods. RSI Overbought Threshold: 70 (standard RSI practice). RSI Oversold Threshold: 30 (standard RSI practice). ATR Length: Typically 14 periods for standard volatility measure. Stop-Loss Multiplier: Recommended range: 1.5-2.5 (default 1.5). Take-Profit Multiplier: Recommended range: 2-4 (default 3). Ideal Usage & Performance Scenarios: Performs well in trending markets (stocks, crypto, forex). Potentially weaker during choppy or sideways markets due to false EMA crossovers. Ideal on timeframes like 1H, 4H, and 1D charts. Known Limitations & Risks: EMA strategies can produce false signals in ranging markets. RSI filter may limit entries in persistently strong trending conditions. ATR-based stops might not accommodate sudden volatility spikes.

Free SuperTrend Pullback SMA Strategy – Crypto Scalping (DODGE) - PineScript

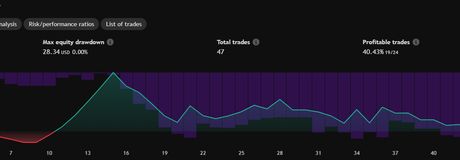

This strategy is built around the concept of combining trend-following and retracement trading techniques using the SuperTrend indicator on a higher timeframe (HTF) and a Simple Moving Average (SMA) on a lower timeframe. Core Concept: Utilizes a dual-timeframe approach where the higher timeframe SuperTrend indicator sets the market direction (bullish or bearish trend). Entries are executed on the lower timeframe, specifically after a brief pullback identified by the price crossing the SMA, capitalizing on short-term retracements within the larger trend. How It Works: Bullish Scenario: SuperTrend indicates bullish direction on the HTF. Wait for the price to dip below the lower timeframe SMA (pullback). Long entry triggers when price subsequently crosses back above the previous bar's high. Bearish Scenario: SuperTrend indicates bearish direction on the HTF. Wait for price to rise above the lower timeframe SMA (pullback). Short entry triggers when price crosses below the previous bar's low. Clearly marked entries, take-profits (TP), and stop-losses (SL) based on defined Risk:Reward (R:R). Key Parameters & Recommended Settings: Higher Timeframe: 45-minute (configurable). ATR Period (SuperTrend): 10 Factor (SuperTrend): 3.0 SMA Period: 30 Risk:Reward Ratio (R:R): 1.4 (configurable) Performance Metrics (Backtested on TradingView) Total Trades: 47 Win Rate: 40.43% Profit Factor: 1.158 Max Drawdown: $28.34 (0.00%) Total Return (P&L): +$12.58 Ideal Usage Scenarios: Optimized for volatile assets, particularly cryptocurrencies like DOGE. Performs best in trending market conditions with frequent, clear pullbacks. Known Limitations & Risks: Moderate win rate; requires disciplined risk management.

StratiZone

StratiZone